Credit cards and loans can be powerful tools when used wisely — but when mismanaged, they can quickly become a source of financial stress and long-term debt. Many people fall into the trap of using credit without understanding how it really works, leading to high-interest balances and a cycle of repayments that seems never-ending.

In this article, you’ll learn how to use credit strategically and safely, without falling into debt, and how to build healthy financial habits around borrowing.

Understand How Credit Works

Before you can manage credit wisely, you need to understand the basics of how it functions.

What is Credit?

Credit is money that you borrow from a bank or financial institution and agree to pay back over time — often with interest. Common types include:

- Credit cards

- Personal loans

- Auto loans

- Installment plans

The Cost of Credit

Whenever you borrow money, the lender charges interest, and possibly fees. The longer you take to repay, the more expensive it becomes.

Tip: Always check the APR (Annual Percentage Rate) — this includes both the interest and any extra charges.

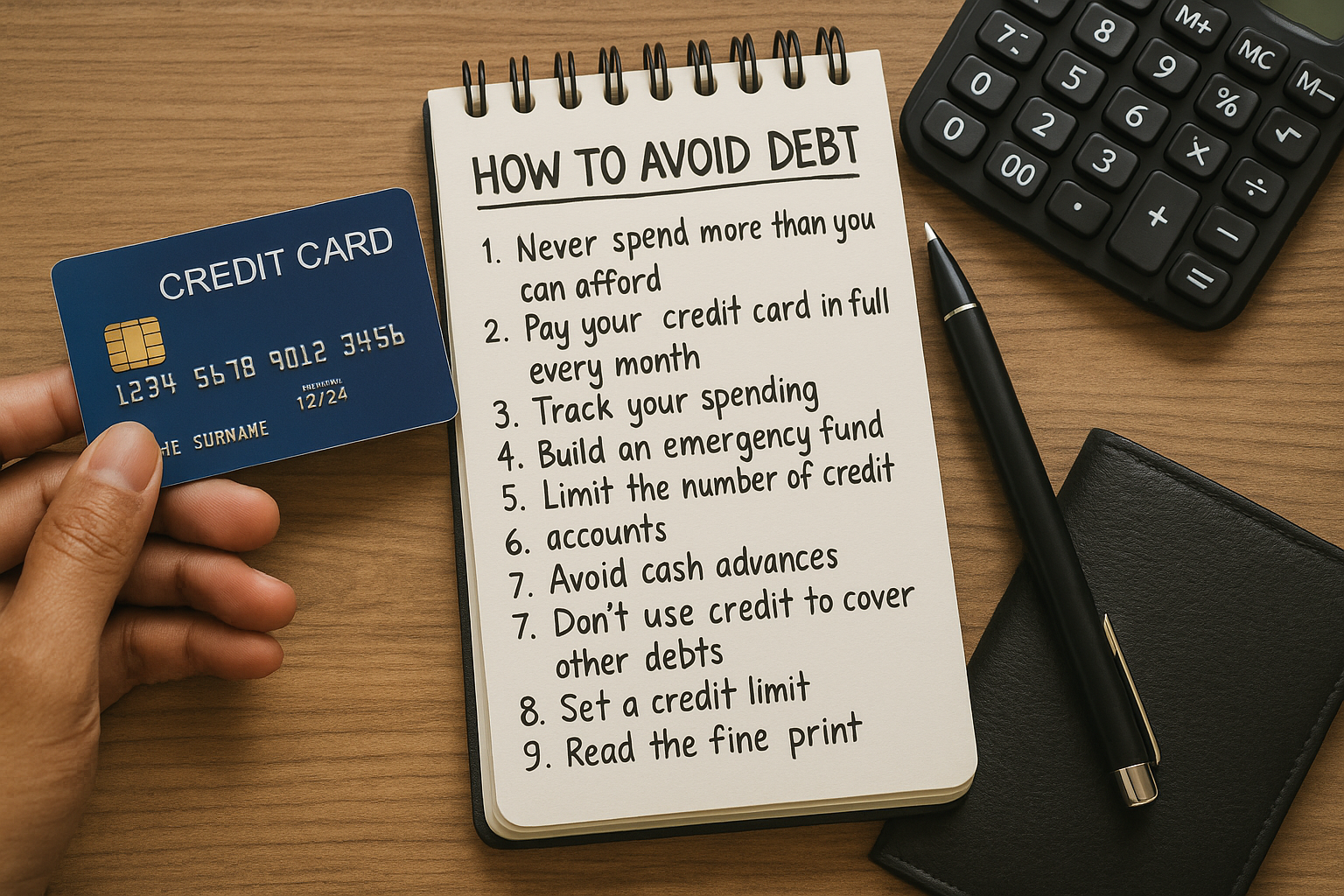

Rule #1: Never Spend More Than You Can Afford

This is the golden rule of credit: only borrow what you can pay off quickly. Credit is not extra income — it’s just a tool to help manage cash flow or make larger purchases responsibly.

Ask Yourself Before Using Credit:

- Do I need this item now?

- Can I pay the full amount when the bill comes?

- Is this an emergency or an impulse?

If you wouldn’t pay cash for it today, reconsider using credit.

Rule #2: Pay Your Credit Card in Full Every Month

Paying only the minimum amount due each month keeps your account in good standing, but it also means you’re being charged interest on the remaining balance.

What Happens When You Only Pay the Minimum:

- You pay more in interest

- Your debt can grow quickly

- It can take years to pay off even small balances

Always aim to pay 100% of your statement balance — this way, you avoid interest charges and stay in control.

Rule #3: Track Your Spending in Real-Time

One of the easiest ways to fall into debt is by losing track of what you’ve spent. When you pay with credit, it’s less painful than spending cash — but just as real.

Use Tools to Monitor Credit Use:

- Budgeting apps (like Mobills, YNAB, or Toshl)

- Alerts from your bank or credit card app

- A simple spreadsheet to log daily purchases

Seeing your spending live helps you make better decisions and stick to your budget.

Rule #4: Build an Emergency Fund

Many people fall into debt because they use credit to handle emergencies. This is risky, especially if interest rates are high.

Emergency Fund Tips:

- Aim to save 3–6 months of essential expenses

- Keep it in a separate, easy-to-access savings account

- Start with small goals (R$500, then R$1,000)

When life happens — a medical bill, car repair, or sudden job loss — you’ll be better prepared to handle it without reaching for a credit card.

Rule #5: Limit the Number of Credit Accounts You Open

The more credit lines you have, the easier it becomes to overextend yourself.

Keep It Simple:

- 1 or 2 credit cards are enough for most people

- Avoid store credit cards unless they offer real value

- Always read the terms and conditions before applying

Opening too many accounts can also hurt your credit score in the short term.

Rule #6: Avoid Cash Advances

Withdrawing money from your credit card (cash advance) may seem convenient, but it comes at a cost:

- High interest rates (often above 10% per month)

- No grace period — interest starts immediately

- Additional withdrawal fees

Only use this feature in extreme emergencies, and repay it as quickly as possible.

Rule #7: Don’t Use Credit to Cover Other Debts

This is called “robbing Peter to pay Paul,” and it often leads to a bigger problem.

Using one credit card to pay another, or taking out a loan to cover a credit balance, can make things worse unless it’s part of a debt consolidation strategy with a clear plan.

If you’re already in debt, consider:

- Creating a debt repayment plan

- Using the Avalanche (highest interest first) or Snowball (smallest balance first) method

- Talking to a financial advisor or credit counselor

Rule #8: Set a Credit Limit for Yourself

Even if your bank gives you a high credit limit, that doesn’t mean you should use it all.

Set Your Own Limit:

- Decide how much you’re comfortable spending per month

- Stick to that limit regardless of your official available credit

- Disable automatic increases unless you need them for a specific purpose

This helps you stay in control and avoid temptation.

Rule #9: Read the Fine Print

Before accepting any credit offer, always check:

- Interest rates

- Annual fees

- Grace periods

- Penalties for late payments

Understanding these terms prevents surprises and ensures you know exactly what you’re agreeing to.

Final Thought: Use Credit as a Tool, Not a Trap

Credit can be a valuable part of your financial strategy — if used wisely. It offers flexibility, convenience, and even rewards in some cases. But it must be treated with respect and discipline.

By following these rules and building a healthy relationship with credit, you can avoid debt, build your credit score, and enjoy the benefits without the stress.