What Is Compound Interest?

Compound interest is one of the most powerful concepts in the world of personal finance and investing. Often called the “eighth wonder of the world” (a phrase attributed to Albert Einstein), compound interest is the process where interest is calculated not only on the initial principal but also on the accumulated interest over time.

In simpler terms, it’s interest on interest. While this may sound basic, it has the potential to significantly grow your wealth over time, especially when combined with patience and consistency.

How Compound Interest Works

To understand how compound interest works, let’s look at a simple example:

Imagine you invest $1,000 in an account that earns 10% interest per year, compounded annually.

- After the first year, you earn $100 (10% of $1,000), bringing your total to $1,100.

- In the second year, you earn 10% on $1,100, which is $110, bringing your total to $1,210.

- By year three, you earn $121 in interest, and so on.

Over time, the interest amount increases each year because it’s calculated on a growing total. This snowball effect is what makes compound interest so powerful.

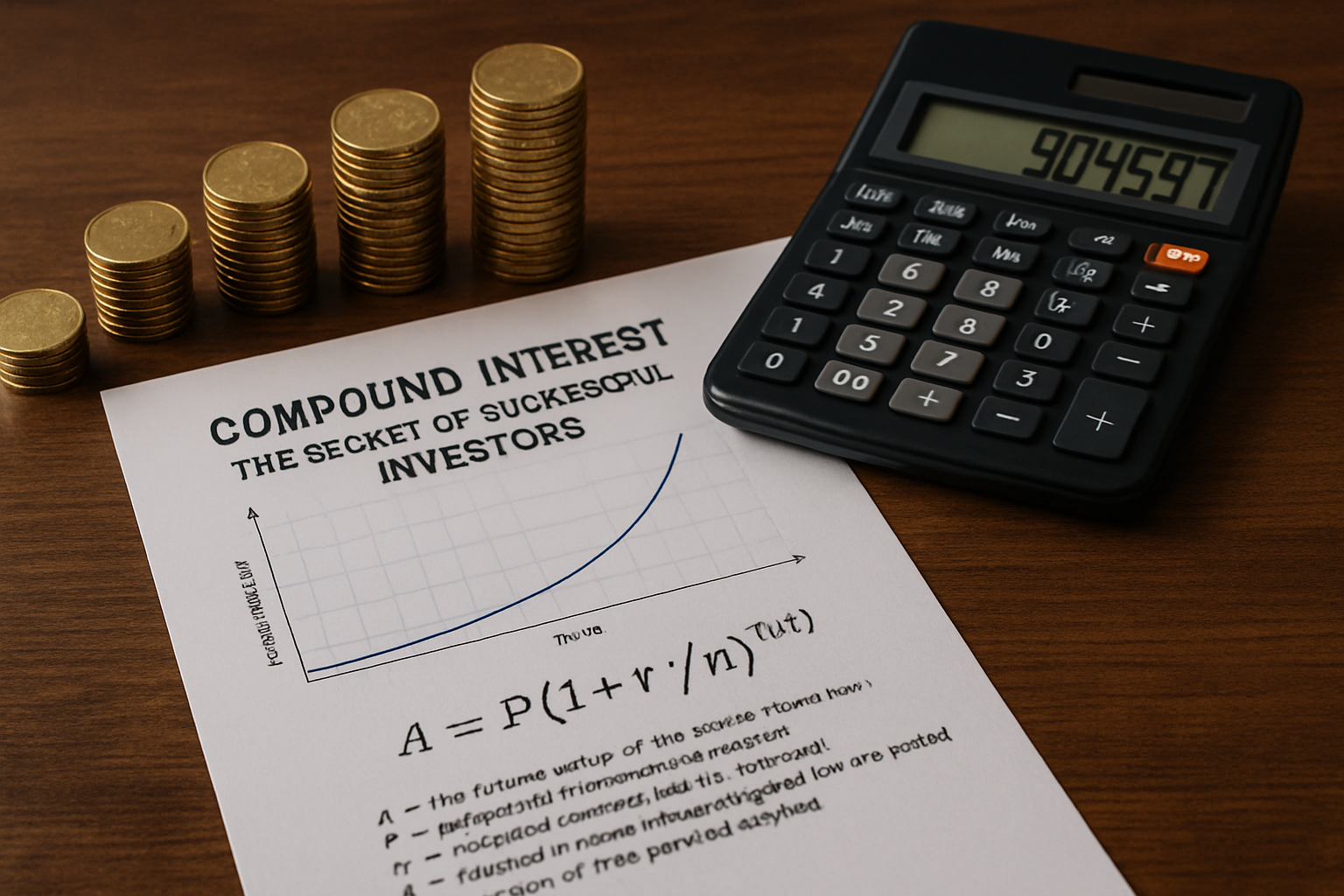

The Formula for Compound Interest

The standard formula for compound interest is:

A = P(1 + r/n)^(nt)

Where:

- A is the future value of the investment/loan, including interest

- P is the principal investment amount

- r is the annual interest rate (decimal)

- n is the number of times that interest is compounded per year

- t is the number of years

Let’s plug in an example:

If you invest $5,000 at an interest rate of 6% compounded monthly for 10 years:

A = 5000(1 + 0.06/12)^(12×10) = 5000(1.005)^120 ≈ $9,045.97

So, your $5,000 almost doubles in 10 years without you doing anything—just letting time and compounding do the work.

Why Time Is Your Greatest Ally

The most important factor in compound interest is time. The longer your money stays invested, the more powerful the compounding effect becomes. That’s why it’s often said that the best time to invest was yesterday, and the second-best time is today.

Here’s a practical example:

- Investor A starts saving at age 25, investing $200/month until age 35, then stops.

- Investor B starts at age 35 and invests $200/month until age 65.

Even though Investor B contributes for 30 years and Investor A only for 10, Investor A often ends up with more money, depending on the returns, simply because their money had more time to grow.

Where Can You See Compound Interest in Action?

Compound interest applies to various financial instruments, including:

- Savings accounts

- Certificates of Deposit (CDs)

- Bonds

- Mutual funds

- 401(k)s and retirement accounts

- Stock dividends (reinvested)

In most of these, if you leave your earnings invested, they start earning returns too.

Compound Interest in Retirement Planning

This principle is especially crucial for retirement planning. Starting early—even with smaller amounts—can make a significant difference.

Let’s say you invest $250/month starting at age 22. At an average return of 7% annually, by age 60, you would have more than $600,000. Someone who starts at 35 would need to invest almost twice as much per month to catch up.

This is why financial advisors emphasize starting as soon as possible.

The Flip Side: Compound Interest in Debt

Compound interest can also work against you—especially with credit cards and loans. When you carry a balance, interest is charged not just on your purchases, but on your unpaid interest as well.

If you don’t pay off your credit card in full each month, you could end up paying hundreds or thousands more than you originally borrowed. That’s why managing high-interest debt should be a financial priority.

How to Take Advantage of Compound Interest

Here are some actionable tips to make compound interest work for you:

- Start Early – Even small investments grow significantly over time.

- Be Consistent – Regular contributions matter more than large, one-time deposits.

- Reinvest Earnings – Always reinvest dividends and interest to maximize growth.

- Avoid Interruptions – Avoid withdrawing from your investments too early.

- Use Retirement Accounts – Tax-advantaged accounts like IRAs and 401(k)s help compounding work faster.

Final Thoughts: The Snowball Effect That Builds Wealth

Compound interest is not just a mathematical concept—it’s a mindset. When you view your money as a tool that can grow itself with time and discipline, your financial strategy changes. You focus more on long-term gains and less on short-term spending.

Even if you’re late to the game, it’s never too late to start. The best financial decisions are the ones you act on today.