Guia Completo para Planejar sua Aposentadoria: Desmistificando o Futuro Financeiro Planejar a aposentadoria é, para muitos, uma tarefa que evoca uma mistura de ansiedade e procrastinação. A ideia de lidar com números complexos, previsões de longo prazo e um futuro incerto pode ser intimidante. No entanto, encarar o planejamento da aposentadoria não precisa ser um … Ler mais

Mudanças Climáticas, Dinheiro e Meio Ambiente: Um Guia para uma Vida Mais Sustentável

As mudanças climáticas são, sem dúvida, o maior desafio do nosso século. Fenômenos extremos, derretimento de geleiras, elevação do nível do mar e perda de biodiversidade são apenas alguns dos sintomas de um planeta que clama por atenção. Mas a relação entre o meio ambiente e a nossa economia é mais intrínseca do que muitos … Ler mais

Planejamento Financeiro em Dia: Dicas para Fechar o Ano Positivo e Sem Dívidas

O final do ano se aproxima e, com ele, a oportunidade de fazer um balanço financeiro e planejar um futuro mais próspero. Para muitos, a virada do ano é sinônimo de festas e gastos extras, mas com um bom planejamento, é possível aproveitar as celebrações sem comprometer a saúde financeira. Fechar o ano no positivo … Ler mais

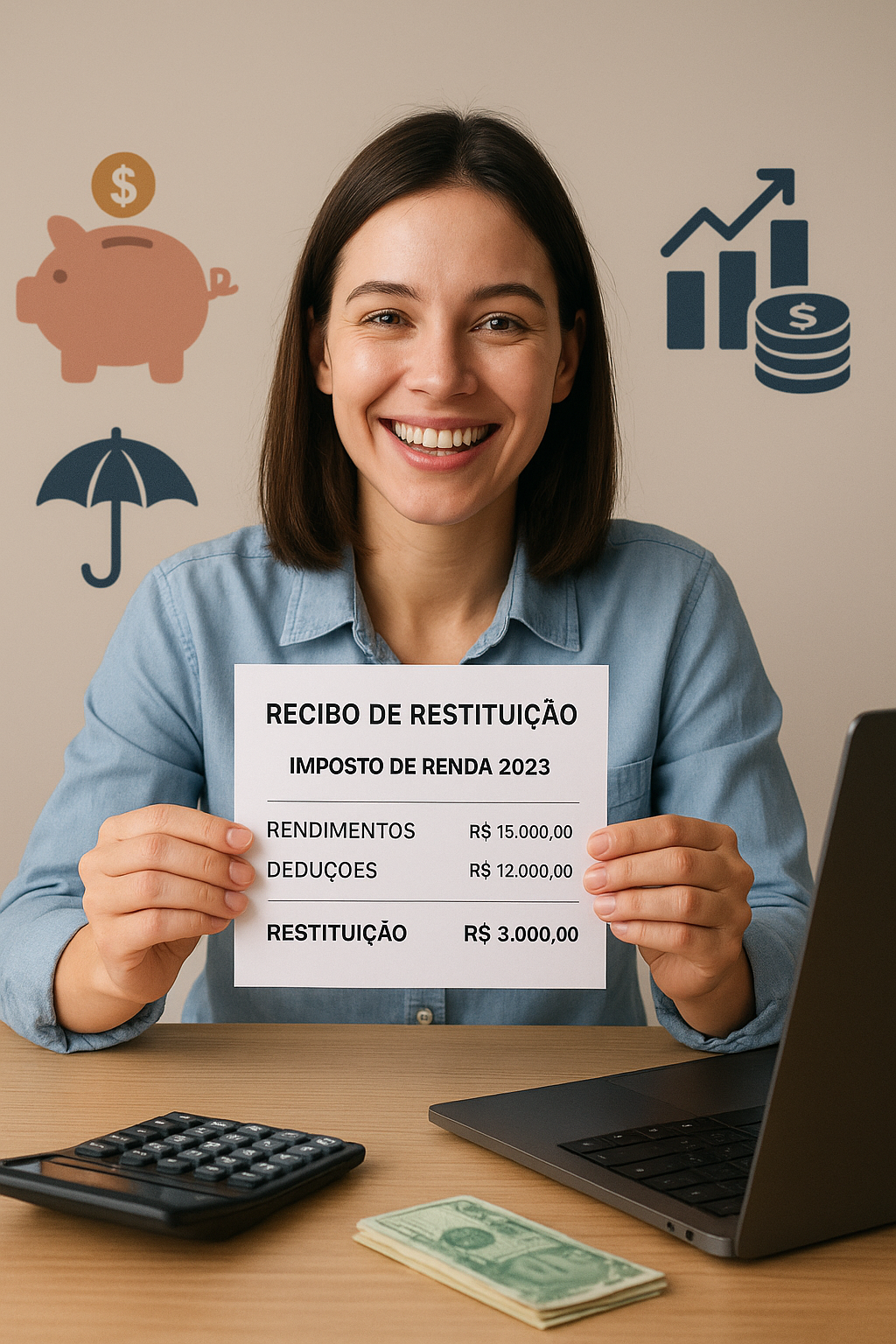

Como o Plano de Previdência PGBL Pode Ser a Chave para Pagar Menos Impostos e Aumentar Sua Restituição

Quando o assunto é planejamento financeiro, poucos brasileiros aproveitam de forma estratégica os benefícios que a previdência privada oferece. Entre os diferentes tipos de planos disponíveis, o PGBL (Plano Gerador de Benefício Livre) se destaca por um motivo que pode surpreender: ele pode ser usado como uma ferramenta legítima de economia tributária, ajudando você a … Ler mais

Desmistificando o Futuro: Estratégias Essenciais para Construir Riqueza e Segurança Financeira em Tempos de Mudança

O mundo financeiro está em constante evolução. Novas tecnologias, mudanças geopolíticas e crises econômicas inesperadas nos lembram diariamente que a estabilidade é uma miragem e a adaptabilidade, uma necessidade. Em um cenário tão dinâmico, construir riqueza e garantir segurança financeira exige mais do que apenas poupar; exige estratégia, conhecimento e, acima de tudo, uma mentalidade … Ler mais

Gestão de Risco: Como Diversificar para Reduzir Perdas sem Comprometer Ganhos

Introdução Investir não é apenas buscar rentabilidade. É também aprender a lidar com riscos. Qualquer decisão de investimento envolve incertezas: a economia pode mudar, uma empresa pode enfrentar dificuldades, ou até mesmo eventos globais inesperados podem impactar todo o mercado. Nesse cenário, a gestão de risco se torna fundamental para proteger o patrimônio e garantir … Ler mais

Dinheiro e Relacionamentos: Como Falar de Finanças com o Parceiro ou a Família sem Perder a Paz

O dinheiro é um dos pilares da vida moderna e, surpreendentemente, um dos tópicos mais delicados em qualquer relacionamento, seja ele conjugal, familiar ou até mesmo entre amigos próximos. A forma como lidamos com as finanças pode ser fonte de grandes alegrias, como a realização de um sonho em comum, mas também de conflitos intensos, … Ler mais

Finanças Comportamentais: Como Emoções e Vieses Influenciam Nossas Decisões de Investimento

Introdução Quando pensamos em investimentos, é comum acreditar que as decisões financeiras são sempre racionais, baseadas em cálculos, análises e números. No entanto, a realidade mostra algo bem diferente: o fator humano tem um peso enorme nas escolhas de onde, quando e como investir. É aqui que entram as finanças comportamentais, uma área de estudo … Ler mais

Finanças para Pequenos Negócios e Empreendedores: Descomplicando a Gestão Financeira e Potencializando o Crescimento

No dinâmico universo do empreendedorismo, a paixão e a visão de negócio são motores poderosos. Contudo, sem uma gestão financeira sólida, até as ideias mais brilhantes podem enfrentar obstáculos intransponíveis. Para pequenos negócios e empreendedores individuais, a linha entre as finanças pessoais e empresariais é frequentemente tênue, e a falta de conhecimento em educação financeira … Ler mais

Alocação de Ativos: A Bússola do Investidor em Meio à Tempestade Econômica

Introdução: Por que sua Alocação de Ativos Precisa ser Dinâmica? Imagine que você é o capitão de um navio. O oceano é o mercado financeiro – às vezes calmo e ensolarado, outras vezes, revoltoso com tempestades imprevisíveis. Sua carteira de investimentos é o navio, e a alocação de ativos é o leme e o sistema de navegação … Ler mais