Investing is a powerful way to grow wealth, but for beginners, it can also be intimidating. The excitement of starting a financial journey often comes with risks—especially when people rush into decisions without the right knowledge. Learning from common mistakes can help you avoid costly errors and build a more stable investment strategy.

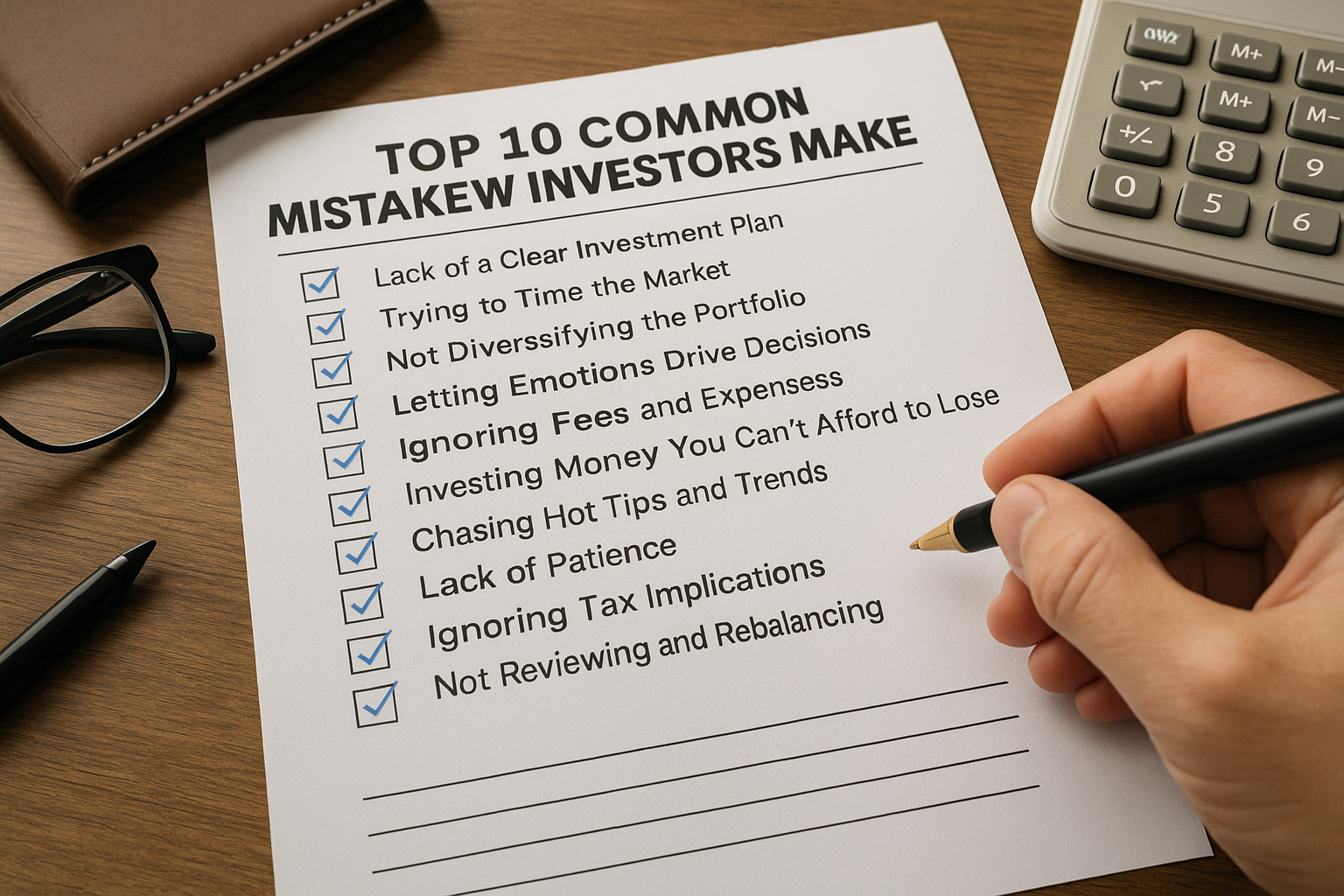

Here are the top 10 mistakes new investors make—and how to avoid them.

1. Lack of a Clear Investment Plan

Jumping into investing without a strategy is like sailing without a compass. Many beginners invest based on hype or emotion rather than defined goals.

What to Do Instead:

- Set specific financial goals (retirement, buying a house, etc.)

- Choose your investment horizon (short-term vs. long-term)

- Determine your risk tolerance

Having a roadmap helps you make consistent and rational choices.

2. Trying to Time the Market

Beginners often try to buy low and sell high by predicting short-term market moves. Unfortunately, even professional investors struggle to time the market accurately.

Why It’s a Mistake:

- Markets are unpredictable

- Missing just a few “best days” can drastically reduce returns

Better Strategy:

Use dollar-cost averaging—investing a fixed amount at regular intervals. It reduces the impact of market volatility.

3. Not Diversifying the Portfolio

Putting all your money into a single stock or sector is a high-risk move. If that investment fails, you could lose a significant portion of your capital.

Diversification Protects You By:

- Spreading risk across different assets (stocks, bonds, real estate, etc.)

- Reducing the impact of any single loss

A balanced portfolio cushions against market downturns.

4. Letting Emotions Drive Decisions

Fear and greed often lead investors to make irrational moves—panic-selling during a dip or buying into hype.

Example:

Selling all your stocks in a market crash may feel safe, but it often locks in losses.

Solution:

Stick to your plan and avoid making decisions based on temporary emotions. History shows that markets recover over time.

5. Ignoring Fees and Expenses

Many new investors overlook management fees, trading costs, or hidden charges. Over time, even small fees can eat into your returns.

What to Watch Out For:

- Expense ratios on mutual funds

- Trading commissions

- Account maintenance fees

Choose low-cost index funds or ETFs and compare providers before committing.

6. Investing Money You Can’t Afford to Lose

Using emergency savings, credit cards, or borrowed money to invest is a dangerous game—especially in volatile markets.

Always Prioritize:

- An emergency fund (3–6 months of expenses)

- Paying off high-interest debt

- Having basic savings before investing

Invest only surplus money you won’t need in the near future.

7. Chasing Hot Tips and Trends

Buying stocks based on social media buzz, Reddit threads, or “insider tips” rarely ends well. Trends fade, and hype can lead to inflated prices.

Risks:

- Buying into overvalued assets

- Making decisions without proper research

Instead, focus on fundamentals—company earnings, financial health, and industry outlook.

8. Lack of Patience

Investing is not a get-rich-quick scheme. Many beginners expect overnight success and feel discouraged by slow growth.

Key Principle:

Time in the market beats timing the market.

Stay invested and let compound interest work its magic over years—not days or weeks.

9. Ignoring Tax Implications

Taxes can significantly affect your investment returns. Many investors overlook how capital gains, dividends, or withdrawals are taxed.

Know the Difference:

- Short-term gains (held less than a year) are taxed higher

- Long-term gains are taxed at a reduced rate

- Tax-advantaged accounts (IRAs, 401(k)s) can help defer or eliminate taxes

Consult a tax professional or research local laws based on your country.

10. Not Reviewing and Rebalancing

Your portfolio shouldn’t be “set and forget.” Over time, assets perform differently, which can shift your intended risk level.

Example:

If stocks outperform, your portfolio may become riskier than planned.

What to Do:

- Review your portfolio annually

- Rebalance by adjusting asset allocations back to your target

- Align your investments with changing goals or life situations

Final Thoughts: Learn, Plan, and Stay the Course

Investing successfully isn’t about avoiding all mistakes—it’s about minimizing them and learning as you go. By building a plan, staying patient, and educating yourself continuously, you’ll avoid the most common pitfalls that trip up new investors.

Remember, it’s not about perfect timing—it’s about time in the market and consistency. Start small, start smart, and stick with it.