Whether you’re applying for a loan, financing a car, or even renting an apartment, your credit score plays a key role in determining how trustworthy you appear as a borrower. It’s more than just a number — it can impact your financial freedom and opportunities.

In this article, you’ll learn what a credit score is, how it’s calculated, why it matters, and — most importantly — how to improve it effectively and responsibly.

What Is a Credit Score?

A credit score is a three-digit number that represents your creditworthiness — your ability to repay borrowed money. It’s calculated by credit bureaus based on your credit history, and it’s used by lenders to assess risk when you apply for credit.

The higher your score, the more likely you are to be approved for loans and get better interest rates.

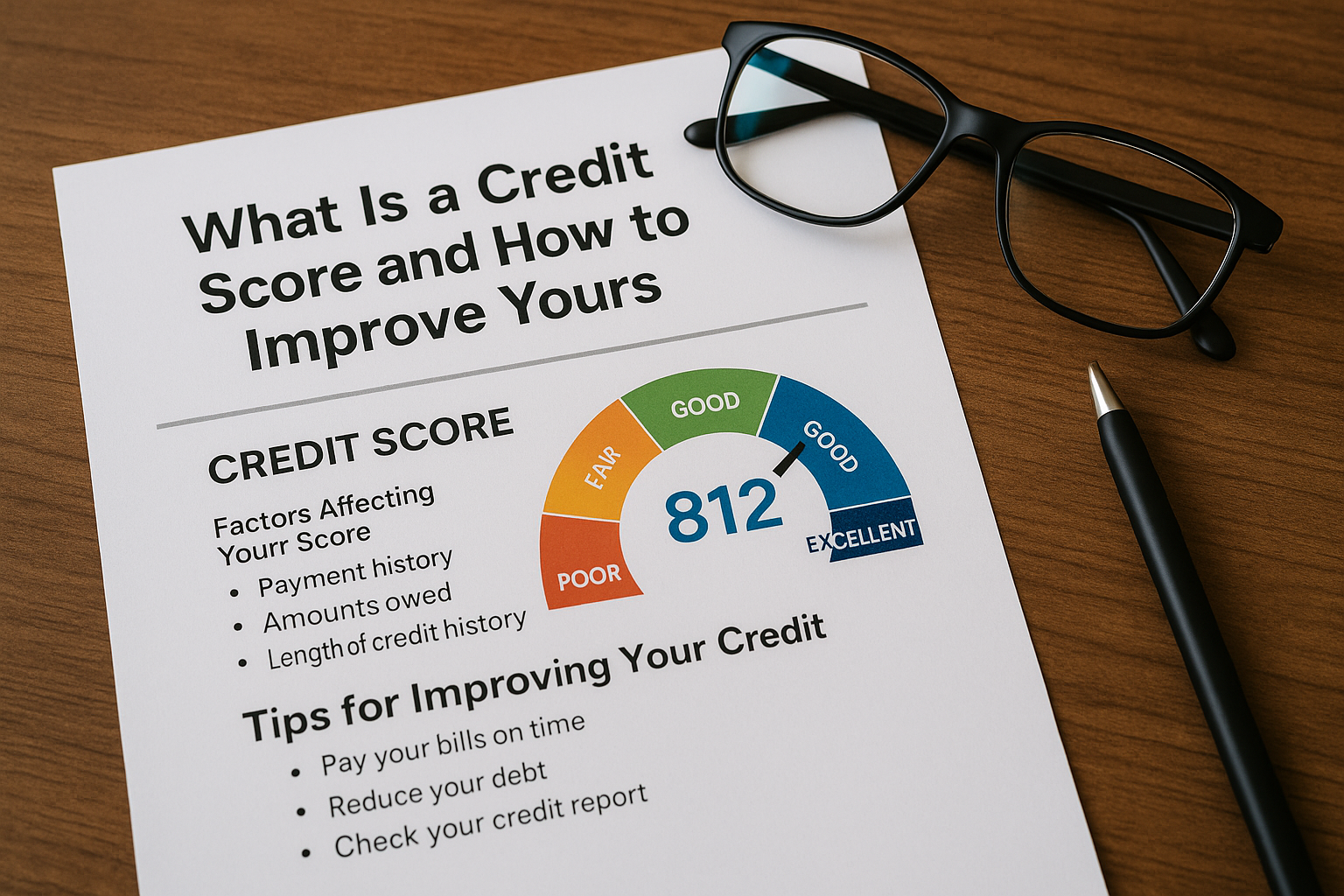

Typical Credit Score Ranges (May vary by country and bureau):

- Excellent: 750 – 850

- Good: 700 – 749

- Fair: 650 – 699

- Poor: 600 – 649

- Very Poor: Below 600

In Brazil, for example, Serasa and Boa Vista are common credit bureaus, and scores range from 0 to 1,000.

Why Is Your Credit Score Important?

A good credit score can make your financial life easier and more affordable. Here’s how:

- Better loan approval chances

- Lower interest rates on credit cards and loans

- Higher credit limits

- Faster approval for financing

- More leverage when renting property or applying for jobs (in some cases)

Poor credit, on the other hand, can lead to rejected applications, high interest costs, and limited access to financial products.

How Is a Credit Score Calculated?

Each country or agency has its own formula, but in general, scores are calculated based on:

1. Payment History (35%)

Have you paid your credit cards, loans, and bills on time? Late payments and defaults hurt your score significantly.

2. Credit Utilization (30%)

How much of your available credit are you using? Lower is better — ideally below 30% of your total limit.

3. Length of Credit History (15%)

How long have you had credit? Older accounts show lenders you’re experienced in managing credit.

4. New Credit (10%)

Opening several credit accounts in a short time can signal risk, which can lower your score.

5. Credit Mix (10%)

Having different types of credit — like credit cards, loans, and financing — can positively affect your score if managed well.

How to Check Your Credit Score

Most credit bureaus offer free access to your score online. In Brazil, for example, you can check through:

It’s a good idea to check your score monthly to monitor your progress and detect fraud or errors early.

10 Proven Ways to Improve Your Credit Score

Improving your credit score takes time and consistency, but the results are worth it. Here’s what you can do:

1. Pay All Your Bills on Time

This is the single most important factor. Set reminders, automate payments, or use financial apps to ensure consistency.

2. Reduce Credit Card Balances

If you’re using more than 30% of your credit limit, work to bring it down. High usage signals risk to lenders.

3. Avoid Applying for Too Much Credit at Once

Each application creates a hard inquiry, which can lower your score temporarily. Only apply when necessary.

4. Keep Old Credit Accounts Open

Even if you don’t use them often, older accounts help increase your average credit history.

5. Dispute Errors on Your Credit Report

Mistakes happen. If you see inaccurate charges or accounts, dispute them with the credit bureau immediately.

6. Use a Credit Builder Loan or Secured Card

If your credit is very low, consider using special products designed to help you build credit safely.

7. Diversify Your Credit Mix

If you only have a credit card, consider adding a small installment loan — but only if you can manage the payments.

8. Don’t Close All Your Cards

Closing multiple accounts reduces your available credit and shortens your credit history, which can lower your score.

9. Negotiate Debts

If you have past-due debts, contact creditors to settle or renegotiate. Some may offer payment plans or discounts that help you clear your name.

10. Be Patient and Consistent

There’s no quick fix — your credit score is built over months and years. Good habits will lead to steady improvement.

Myths About Credit Scores

Let’s bust some common myths:

- “Checking my own credit score will hurt it.”

False. You can check your own score as often as you want — this is called a “soft inquiry” and doesn’t impact your rating. - “I need to carry a balance to build credit.”

False. Paying your credit card in full helps your score — you don’t need to pay interest to build credit. - “Income affects my credit score.”

False. Your income isn’t factored into the score itself (though it may influence lending decisions).

Final Thought: Your Credit Score Is a Tool — Not a Label

Your credit score doesn’t define your worth — it’s just a number that reflects how you’ve managed money in the past. But the good news is that you can change and improve it starting today.

With patience, smart decisions, and discipline, you’ll not only boost your credit score but also gain access to better financial opportunities for your future.